The Trump Presidency: A Deep Dive into 4 Pivotal Economic Decisions

Donald Trump’s presidency was marked by a bold, often unconventional approach to economic policy. From sweeping tax reforms to contentious trade disputes, his administration aimed to reshape the American economic landscape. Understanding these pivotal decisions is crucial for grasping the long-term economic implications and the ongoing debates surrounding his tenure. This deep dive explores four key economic decisions that defined the Trump era.

1. The Tax Cuts and Jobs Act of 2017: A Seismic Shift in Corporate Taxation

Perhaps the most significant legislative achievement of the Trump administration was the Tax Cuts and Jobs Act of 2017. This sweeping legislation fundamentally altered the U.S. corporate and individual tax codes.

Key Provisions and Economic Rationale:

- Corporate Tax Rate Reduction: The most prominent feature was the dramatic reduction of the corporate tax rate from 35% to 21%. The rationale behind this was to make American businesses more competitive globally, encourage domestic investment, and incentivize companies to bring overseas profits back to the U.S.

- Individual Tax Changes: The act also included temporary changes to individual income tax rates, deductions, and credits. Many of these provisions were designed to expire after 2025.

Economic Impact and Debate:

The economic effects of the Tax Cuts and Jobs Act remain a subject of intense debate. Supporters argued it spurred business investment and job creation. Data from the time did show an increase in business investment, but its direct correlation to the tax cuts is debated, with some economists pointing to pre-existing trends. Critics contended that the cuts disproportionately benefited corporations and wealthy individuals, widening income inequality, and adding significantly to the national debt without delivering the promised sustained surge in GDP growth.

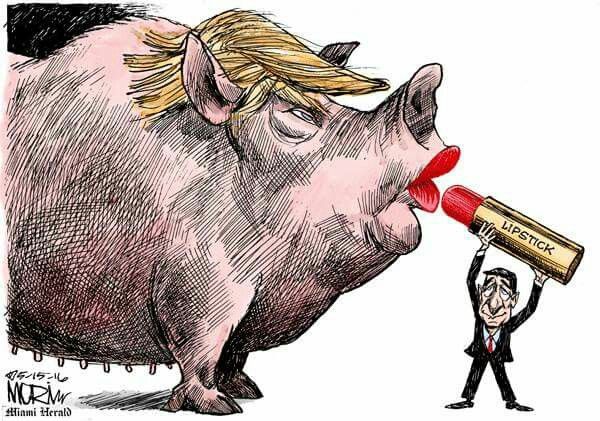

2. The Trade War: Tariffs as a Strategic Weapon

Donald Trump’s “America First” trade policy was characterized by a willingness to challenge existing trade agreements and impose tariffs on goods from key trading partners, most notably China. This aggressive stance aimed to reduce trade deficits and protect American industries.

Tariffs on Goods from China and Other Nations:

The administration initiated a series of tariffs on billions of dollars worth of Chinese imports, citing unfair trade practices and intellectual property theft. Tariffs were also imposed on goods from other countries, including steel and aluminum from allies like the European Union and Canada.

Economic Ramifications:

The imposition of tariffs had a dual impact. For some domestic industries, particularly those protected by tariffs, there was a perceived benefit in terms of reduced foreign competition. However, these measures also led to retaliatory tariffs from trading partners, hurting American exporters, particularly in the agricultural sector. Consumers often faced higher prices due to increased import costs, and businesses that relied on imported components experienced supply chain disruptions and increased operational expenses. Investors often feared that these tariffs would stoke inflation and depress economic growth, as noted by The Economist. The uncertainty surrounding trade policy also played a role in business decision-making.

3. Deregulation: Unleashing Business Growth

A cornerstone of Trump’s economic agenda was a broad push for deregulation across various sectors, including environmental protection, finance, and energy. The administration believed that reducing regulatory burdens would unleash private sector growth and innovation.

Key Deregulatory Actions:

This included rolling back environmental regulations, easing financial oversight rules, and streamlining permitting processes for infrastructure projects. The stated goal was to reduce compliance costs for businesses and stimulate economic activity.

Economic Outcomes and Concerns:

Proponents argued that deregulation stimulated investment and created jobs by removing obstacles to business operations. Critics, however, voiced concerns about the potential for increased environmental damage, financial instability, and risks to public health and safety. The long-term economic impact of these deregulatory efforts is complex to isolate, as they often intersected with other policy changes and broader economic trends.

4. Re-negotiating Trade Agreements: NAFTA and Beyond

Beyond imposing tariffs, the Trump administration actively sought to renegotiate major trade agreements, most notably the North American Free Trade Agreement (NAFTA). The aim was to create more favorable terms for the United States.

The United States-Mexico-Canada Agreement (USMCA):

NAFTA was replaced by the United States-Mexico-Canada Agreement (USMCA). Key changes included updated provisions on automotive rules of origin, labor and environmental standards, and digital trade. The administration hailed the USMCA as a victory that would bring manufacturing jobs back to America.

The Debate Over Trade Deals:

The economic impact of the USMCA is still being assessed. Supporters believe it offers a more balanced framework for North American trade, potentially boosting American manufacturing. Skeptics argue that the changes were incremental and that the agreement, like its predecessor, may not fundamentally alter the trajectory of manufacturing employment, which is heavily influenced by automation and global supply chains. This re-negotiation effort reflected a broader skepticism towards multilateral trade agreements, with the administration signaling a willingness to walk away from deals perceived as disadvantageous.

Conclusion: A Complex Economic Legacy

The economic decisions made during the Trump presidency were ambitious and far-reaching, leaving a complex and debated legacy. The Tax Cuts and Jobs Act aimed to boost corporate competitiveness, while trade policies like tariffs sought to rebalance global trade. Deregulation was pursued to reduce business burdens, and trade agreements were renegotiated to favor American interests.

For business leaders and policymakers, understanding the intricacies of these decisions—from the precise impact of tax cuts on investment to the ripple effects of tariffs on global supply chains—is vital. As you navigate the current economic landscape, consider how these past policies continue to shape the environment for growth, investment, and international trade. The economic history of the Trump years offers valuable lessons for future policy formulation, emphasizing the delicate balance between stimulating domestic growth and maintaining global economic stability.

Additional Information

The Trump Presidency: A Deep Dive into 4 Pivotal Economic Decisions

Donald Trump’s presidency, marked by an “America First” ethos, ushered in a series of bold economic policies. His tenure was characterized by promises of economic revival, tax relief, and a significant shift in trade dynamics. Nearly four years after he left office, the economic legacy of his policy agenda remains a subject of fervent debate, with differing analyses highlighting both perceived successes and significant criticisms. While the labor market generally remained strong during his term, the long-term impacts of his decisions on growth, inflation, and the overall economic landscape continue to be dissected.

This deep dive will explore four pivotal economic decisions that defined the Trump presidency, examining their objectives, immediate impacts, and ongoing consequences:

1. The Tax Cuts and Jobs Act of 2017:

- The Decision: This landmark legislation enacted the most significant overhaul of the U.S. tax code in decades. Key provisions included a substantial reduction in the corporate tax rate from 35% to 21%, a restructuring of individual income tax brackets with lower rates for most, and changes to deductions and international taxation.

- Objectives: The primary goals were to stimulate business investment, boost economic growth, create jobs, and encourage companies to repatriate profits held overseas. The administration argued that a lower corporate tax rate would make the U.S. more competitive globally and incentivize companies to invest and hire domestically.

- Analysis and Impact:

- Proponents: Supporters pointed to the immediate surge in corporate profits and a stock market rally as evidence of the Act’s success. They argued that the tax cuts provided businesses with more capital for investment, which theoretically should translate into job creation and wage growth. The repatriation of overseas profits was also seen as a positive, bringing foreign capital back into the U.S. economy.

- Critics: Conversely, critics argued that the benefits disproportionately favored corporations and the wealthy, exacerbating income inequality. While there was a short-term boost to corporate profits, the link to sustained wage growth and job creation was less clear. Many economists contended that the tax cuts added significantly to the national debt without delivering the promised level of economic expansion. The Economist noted that investors feared tariffs could stoke inflation and depress growth, suggesting a broader economic uncertainty despite the tax cuts. The Joint Economic Committee’s final scorecard, for instance, highlighted concerns about fewer jobs and slower GDP growth upon Trump’s departure, implying that the tax cuts did not fully materialize their intended long-term economic benefits.

- Lingering Debate: The debate continues regarding whether the tax cuts truly unleashed broad-based economic growth or merely enriched the wealthy, as suggested by some analyses. The long-term impact on the national debt remains a significant concern.

2. The Imposition of Tariffs and the “Trade War”:

- The Decision: A cornerstone of Trump’s “America First” economic agenda was a willingness to challenge existing trade agreements and impose tariffs on goods from key trading partners, most notably China, but also on allies like Canada and Mexico. These actions were often framed as necessary to address unfair trade practices, protect domestic industries, and reduce trade deficits.

- Objectives: The stated aims were to level the playing field for American businesses and workers, bring manufacturing jobs back to the U.S., and compel other nations to adopt more equitable trade policies. Trump frequently expressed his belief that the U.S. had been exploited by unfavorable trade deals like NAFTA (which was renegotiated into the USMCA) and by China’s trade practices.

- Analysis and Impact:

- Proponents: Supporters argued that tariffs provided much-needed leverage in trade negotiations and signaled a commitment to defending American economic interests. They pointed to the renegotiation of NAFTA into the USMCA as a tangible win, along with some initial success in securing commitments from China on certain trade practices. The argument was that protecting nascent domestic industries would eventually lead to stronger, self-sufficient American manufacturing.

- Critics: The imposition of tariffs had significant economic repercussions. Importers faced higher costs, which were often passed on to consumers in the form of higher prices, contributing to inflationary pressures. American businesses that relied on imported components saw their production costs increase, potentially impacting competitiveness. Farmers, in particular, suffered from retaliatory tariffs imposed by China and other countries, leading to a decline in exports and the need for government aid. The Economist highlighted investor fears that tariffs would “stoke inflation and depress economic growth,” a concern that materialized in various sectors. The unpredictability of these trade actions created uncertainty for businesses, hindering long-term investment planning. Rolling Stone’s deep dive noted the heated debate on whether these policies unleashed growth or merely enriched the wealthy.

- Global Implications: The trade disputes created global economic instability and strained diplomatic relations with key allies. The effectiveness of tariffs in fundamentally altering trade balances or bringing back large numbers of manufacturing jobs in the long term remains a subject of intense scrutiny.

3. Deregulation Across Various Sectors:

- The Decision: The Trump administration pursued a policy of broad-based deregulation, seeking to reduce what it characterized as burdensome and costly federal regulations that hampered business growth. This included rolling back environmental regulations, financial sector rules, and other industry-specific oversight.

- Objectives: The overarching goal was to unleash the private sector by removing perceived impediments to innovation, investment, and job creation. The administration believed that excessive regulation stifled economic activity and that reducing these burdens would lead to a more dynamic and competitive economy.

- Analysis and Impact:

- Proponents: Businesses in sectors heavily affected by regulation, such as energy and manufacturing, often welcomed the deregulation. They argued that it lowered compliance costs, allowed for greater operational flexibility, and encouraged investment in new projects, particularly in fossil fuel industries. This was seen as a direct implementation of the “America First” prosperity agenda.

- Critics: Environmental advocates and many economists expressed significant concerns that the rollback of regulations, particularly environmental protections, would have detrimental long-term consequences for public health and the environment. They argued that these regulations were essential for mitigating risks associated with pollution, climate change, and resource depletion. The potential for increased systemic risk in the financial sector due to weakened oversight was also a point of contention. Investopedia noted that Trump rolled out sweeping economic changes affecting everything from grocery bills to retirement accounts, underscoring the broad reach of his deregulatory agenda.

- Long-Term Consequences: The full impact of these deregulatory actions will likely be felt over decades, particularly concerning environmental quality and public health. The extent to which deregulation directly contributed to economic growth, as opposed to other factors, remains a complex question.

4. Immigration Policy and its Economic Implications:

- The Decision: While often framed through a security and cultural lens, the Trump administration’s immigration policies had significant economic implications. These included increased enforcement, stricter border controls, efforts to reduce both legal and illegal immigration, and the implementation of policies like the “travel ban” affecting certain countries.

- Objectives: The stated objectives were to enhance national security, protect American jobs by reducing competition from foreign workers, and uphold the rule of law. The administration argued that unchecked immigration placed a strain on public resources and depressed wages for low-skilled American workers.

- Analysis and Impact:

- Proponents: Supporters of these policies argued that they helped to control the labor market, potentially leading to higher wages for native-born workers and reducing unemployment among certain demographics. They also contended that reduced immigration would alleviate pressure on social services and infrastructure.

- Critics: Many economists and business leaders warned that stricter immigration policies could negatively impact economic growth by shrinking the labor force and reducing demand. Immigrants, both documented and undocumented, play a crucial role in various sectors, including agriculture, construction, and hospitality, often filling labor shortages. The reduction in the labor force was a key point in the Joint Economic Committee’s “Final Economic Scorecard,” which cited a smaller labor force upon Trump’s departure. The threat of such policies, as highlighted in some analyses, demonstrated the President’s potential to shape the global economic landscape through executive decisions. Furthermore, limiting the inflow of skilled workers could stifle innovation and competitiveness in high-tech industries.

- Demographic and Labor Market Shifts: The long-term economic consequences of altered immigration patterns include potential demographic shifts and a shrinking workforce, which could have implications for social security and economic productivity.

Conclusion:

The Trump presidency enacted policies that aimed to fundamentally reshape the American economy, prioritizing national interests and challenging established economic orthodoxies. The Tax Cuts and Jobs Act sought to stimulate growth through lower corporate taxes, while tariffs aimed to renegotiate global trade dynamics. Deregulation was intended to free up businesses, and immigration policies were presented as a means to protect American jobs.

However, the economic legacy of these decisions is complex and hotly debated. While proponents point to a strong labor market for much of his term, critics highlight the growing national debt, increased income inequality, and potential long-term economic and environmental costs. The “America First” approach, while resonating with a segment of the population, also introduced significant uncertainty and challenged the interconnected global economy. A comprehensive understanding of the Trump presidency’s economic impact requires a nuanced analysis of these pivotal decisions and their multifaceted consequences, both immediate and enduring.

Leave a Reply