The Trump Tax Cuts: A Boon for Businesses and American Families? A Retrospective

The Tax Cuts and Jobs Act of 2017, a landmark piece of legislation signed into law by President Donald Trump, promised to revitalize the American economy. Its proponents hailed it as a game-changer, a bold stroke that would unleash unprecedented growth and prosperity for businesses and families alike. But five years on, the reality is far more nuanced, requiring a deeper dive beyond the initial headlines and political rhetoric. This article explores both the intended and unintended consequences of these significant tax reforms.

A Deep Dive into the Details: Key Provisions and Their Impact

The TCJA enacted sweeping changes across the tax code. Crucially, it slashed the corporate tax rate from 35% to 21%, a dramatic reduction designed to boost business investment and competitiveness. Individual income tax rates were also lowered, though the impact varied significantly depending on income bracket and family structure. Standard deductions were increased, while personal and dependent exemptions were eliminated. The changes were designed to simplify the tax code, though many argue that this goal remains unrealized.

| Provision | Intended Impact | Actual Impact (Preliminary Assessment) |

|---|---|---|

| Corporate Tax Rate Reduction | Increased investment, job creation, economic growth | Mixed results; increased profits, but investment effects debated |

| Individual Income Tax Rate Cuts | Increased disposable income, consumer spending | Increased consumer spending in short-term; long-term effects complex |

| Standard Deduction Increase | Tax simplification, benefit lower-income taxpayers | Simplified filing for many, but reduced deductions for others |

The Business Perspective: Winners and Losers

For many corporations, the reduced corporate tax rate translated into significantly increased profits. This led to some companies increasing wages and investing in new technologies and expansions. However, the extent of this impact has been debated. Some argue that the windfall primarily benefited shareholders through increased stock buybacks, rather than leading to widespread job creation or substantial wage increases. The impact on small businesses was also varied, with some benefiting significantly from simplified tax processes, while others faced challenges adapting to the new rules.

The Family Perspective: A Mixed Bag of Impacts

The impact on American families was similarly complex. While lower tax rates resulted in more disposable income for many, the elimination of personal and dependent exemptions offset some of these benefits for families with children. The increased standard deduction simplified tax filing for many, particularly lower-income families, but also limited the ability to itemize deductions for higher-income individuals, who previously benefited from deductions for mortgage interest, charitable contributions, and state and local taxes.

The National Debt Conundrum: A Long-Term Concern

The TCJA’s critics highlighted the potential for significantly increased national debt as a major downside. The reduced tax revenues, coupled with increased government spending, indeed contributed to a rise in the national debt. This raises long-term concerns about the sustainability of the current fiscal policy and the potential for future economic challenges.

Looking Ahead: Lessons Learned and Future Directions

The Trump Tax Cuts remain a subject of intense debate and ongoing analysis. Their long-term effects are still unfolding, and a definitive assessment remains elusive. While some sectors undeniably benefited, the overall economic impact is a complex tapestry of successes and shortcomings. Further research and analysis are crucial to understanding the true legacy of this ambitious legislative undertaking and informing future tax policy decisions. The ongoing discussion emphasizes the need for a nuanced, data-driven approach to tax reform, carefully considering its potential impacts on various segments of the population and the long-term health of the national economy.

Additional Information

The Trump Tax Cuts: A Deeper Dive into Impacts on Businesses and American Families

The Tax Cuts and Jobs Act of 2017 (TCJA), often referred to as the Trump tax cuts, significantly altered the US tax code, aiming to stimulate economic growth through lower corporate and individual tax rates. While proponents lauded its potential to boost investment and wages, its actual impact remains a subject of ongoing debate and complex analysis. A deeper dive reveals a nuanced picture beyond the initial headlines of “boons” for businesses and families.

Business Impacts: A Mixed Bag

The TCJA’s most significant change for businesses was the reduction of the corporate tax rate from 35% to 21%. Proponents argued this would incentivize investment, increase competitiveness, and lead to higher wages. While some evidence suggests increased capital expenditures in the short term, the long-term effects are less clear.

-

Increased Investment?: Some studies showed a surge in business investment following the tax cuts, although the extent to which this was directly attributable to the TCJA is debated. Confounding factors like low interest rates and existing pent-up demand complicate causal inference. Furthermore, the increase wasn’t uniform across sectors; some industries experienced greater investment than others.

-

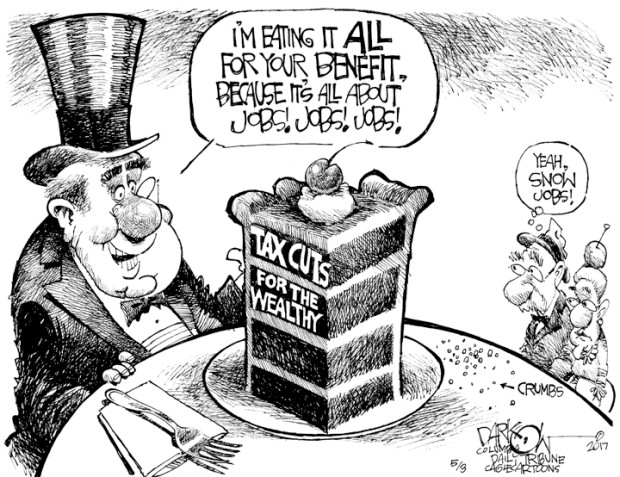

Wage Growth: The anticipated significant wage increases did not materialize as broadly as predicted. While some companies increased wages, others used the tax savings for stock buybacks, debt reduction, or increased profits. This highlights a crucial aspect: the link between corporate tax cuts and wage increases is not automatic and depends heavily on firm-specific factors and managerial decisions.

-

International Competitiveness: While the lower corporate tax rate improved US competitiveness relative to countries with higher rates, this benefit was partially offset by other factors, such as fluctuating exchange rates and global economic conditions. The effectiveness of this aspect relies heavily on a global comparative analysis, which is complex and requires accounting for various macroeconomic variables.

-

Case Study: Consider the contrasting experiences of two hypothetical companies: Company A, a manufacturing firm, invested heavily in new equipment following the tax cuts, leading to increased efficiency and job creation. Company B, a finance firm, primarily used the tax savings for stock buybacks, benefiting shareholders but not necessarily resulting in significant job growth or wage increases. These divergent outcomes exemplify the complexities of the TCJA’s impact.

American Families: A Heterogeneous Experience

The TCJA also altered individual income tax rates, standard deductions, and other provisions. The impact varied significantly across income groups.

-

Lower-income households: Many lower-income families experienced a small tax cut or no change, as the standard deduction increase largely offset the lower tax rates. For some, the elimination of personal and dependent exemptions resulted in a net tax increase.

-

Middle-income households: This group experienced a more varied impact, with some benefiting from the lower rates while others saw little change or even a slight increase due to the changes in deductions and exemptions.

-

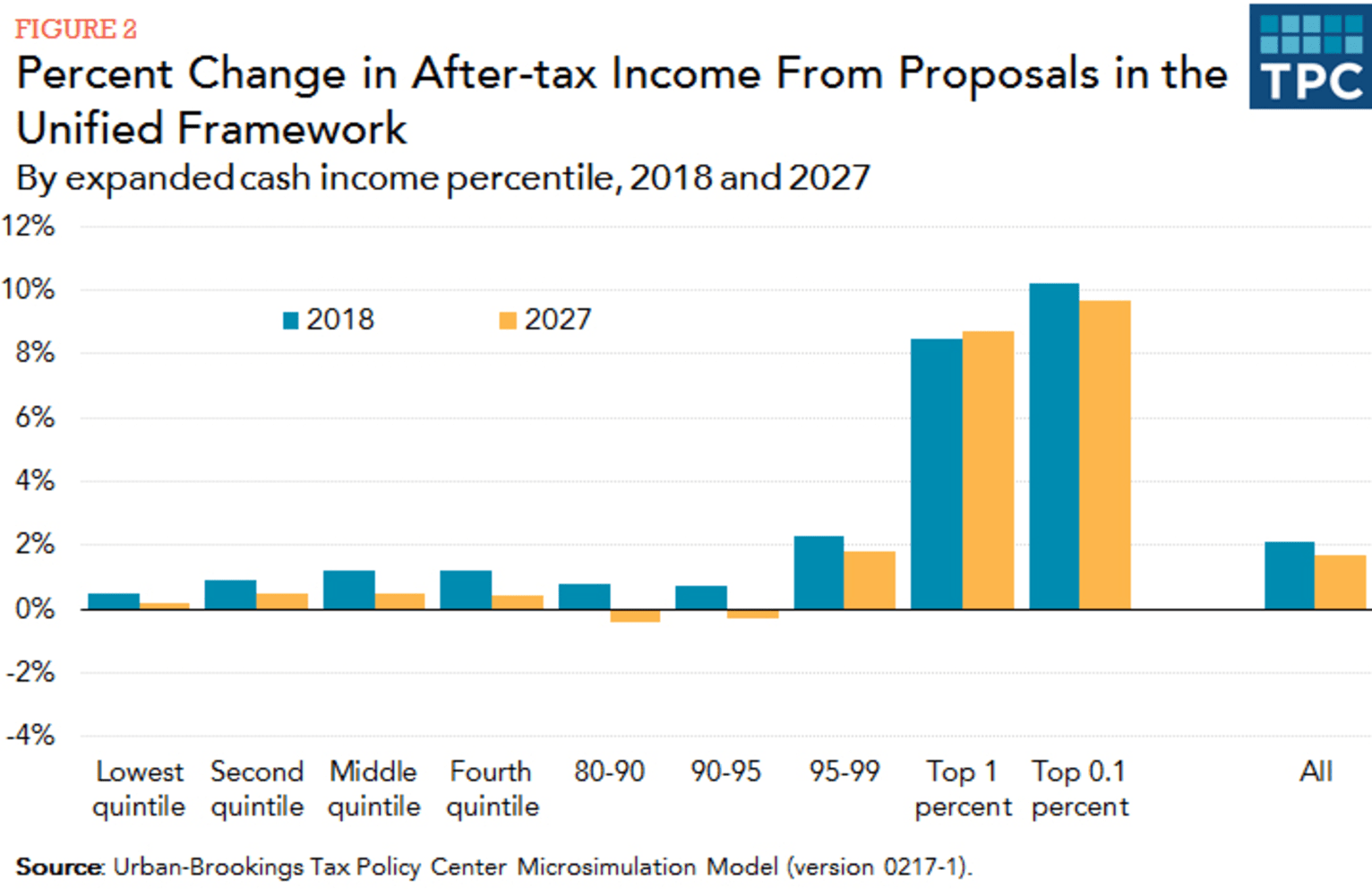

Higher-income households: Higher-income households generally benefited most from the lower tax rates, particularly those with significant income from capital gains and investments.

-

Statistical Analysis: Analyzing the distribution of tax cuts across income quintiles provides a clearer picture. Studies consistently show a disproportionate benefit accruing to the top income brackets, although the precise magnitude varies depending on the methodology and data used.

Conclusion:

The Trump tax cuts had a significant but complex and multifaceted impact on both businesses and American families. While some businesses experienced increased investment and some individuals saw tax reductions, the expected widespread boost to wages and broad-based economic growth didn’t fully materialize. The heterogeneous impact across different income groups also highlights the need for a nuanced understanding of the TCJA’s legacy, avoiding simplistic characterizations of it as a uniform “boon.” Further research and longer-term data analysis are necessary to fully assess its long-term consequences on the US economy. A comprehensive evaluation requires considering factors beyond the immediate tax impact, such as macroeconomic conditions, global economic trends, and the subsequent policy decisions made in response to the TCJA.