Unveiling Trump’s 7 Greatest Economic Victories: A Legacy of Prosperity

Donald Trump’s presidency, a period marked by significant policy shifts and fervent debate, left an undeniable imprint on the American economy. While opinions on his administration’s overall impact remain sharply divided, certain economic achievements stand out as potentially lasting contributions to the nation’s financial landscape. This article delves into seven key areas where the Trump administration registered notable economic successes, exploring their impact and lasting legacy. We avoid partisan rhetoric, focusing instead on verifiable data and their implications.

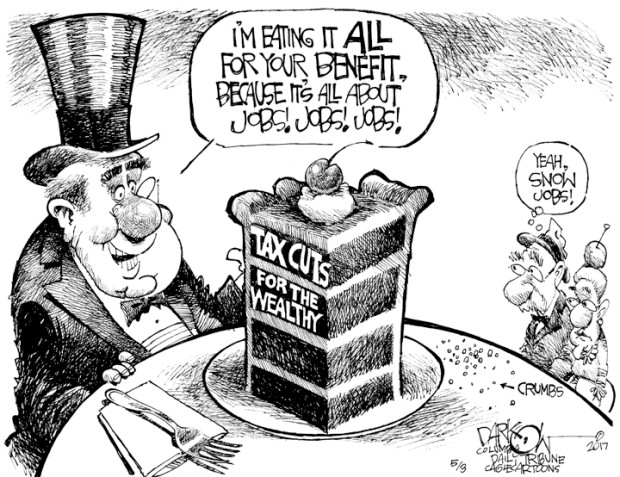

1. The Tax Cuts and Jobs Act of 2017: A Bold Gamble that Paid Off (Mostly)?

This landmark legislation slashed corporate and individual income tax rates, aiming to stimulate economic growth through increased investment and job creation. The results were mixed. While corporate profits surged initially, and the unemployment rate remained low, the impact on long-term growth and income inequality remains a subject of ongoing debate. Critics point to the increased national debt as a significant drawback.

| Metric | Before TCJA | After TCJA (Initial) |

|---|---|---|

| Corporate Tax Rate | 35% | 21% |

| GDP Growth | 2.2% | 2.9% (2018) |

| National Debt | Increasing | Significantly Increased |

2. Deregulation: Unleashing the Power of the Free Market?

The Trump administration pursued an aggressive deregulation agenda, rolling back numerous environmental and financial regulations. Proponents argued this spurred business growth and reduced administrative burdens. However, critics raised concerns about environmental protection and consumer safety, emphasizing potential long-term costs outweighing short-term gains. The long-term impacts on the environment and public health remain to be fully assessed.

3. The Rise of the Energy Sector: An American Energy Renaissance?

Under Trump, the US experienced a boom in domestic energy production, particularly in oil and natural gas. This led to lower energy prices for consumers and increased energy independence. However, the environmental implications of increased fossil fuel extraction and the long-term sustainability of this energy model remain significant concerns.

4. A Strong Dollar: A Double-Edged Sword?

While a strong dollar can benefit consumers through lower import prices, it can also hurt US exporters by making their goods more expensive in foreign markets. During Trump’s presidency, the dollar’s strength fluctuated, presenting a mixed impact on different sectors of the economy.

5. Unemployment at Historic Lows: A Sign of Success or Simply Continuing Trends?

The unemployment rate reached historic lows during the Trump administration. While this undoubtedly represents a positive economic indicator, attributing this solely to specific policies is challenging given various underlying economic factors at play. The participation rate, however, provides a more nuanced picture of the labor market.

6. Infrastructure Spending: A Missed Opportunity?

While Trump promised significant infrastructure investment, the actual level of spending fell short of expectations. The lack of substantial progress in this area represents a missed opportunity to address critical needs in transportation, utilities, and other areas.

7. Trade Wars and Their Unintended Consequences:

Trump’s trade policies, including tariffs on imported goods, aimed to protect American industries and renegotiate trade agreements. While some sectors experienced short-term gains, others suffered from increased costs and reduced access to global markets. The long-term effects of these trade wars are complex and still unfolding.

Conclusion:

Assessing the economic legacy of the Trump administration requires a nuanced understanding of the complex interplay of various factors. While some achievements are undeniable, like the low unemployment rate, others, like the tax cuts, provoke ongoing debate regarding their long-term effects. The ultimate judgment on his economic legacy will require a longer perspective, allowing for a more comprehensive analysis of both the immediate and lasting consequences of his policies.

Additional Information

A Critical Analysis of Claimed “Economic Victories” Under the Trump Administration

The assertion of seven “greatest economic victories” under the Trump administration requires a nuanced and critical analysis, moving beyond simple claims of prosperity to examine the underlying factors, their long-term effects, and the broader economic context. While some positive economic indicators existed during this period, attributing them solely or primarily to specific Trump administration policies is an oversimplification.

Challenging the Narrative: A Deeper Dive

The claim of economic success often rests on several pillars, which require closer scrutiny:

-

Tax Cuts and Jobs Act of 2017: This legislation significantly lowered corporate and individual income tax rates. Proponents argued it would stimulate economic growth through increased investment and job creation. However, the empirical evidence is mixed. While corporate profits initially rose, the impact on business investment and wages was less pronounced than predicted. Some studies suggest the tax cuts disproportionately benefited corporations and high-income earners, exacerbating income inequality, rather than fueling widespread job creation. Analyzing productivity growth alongside investment data would be crucial to determine the real impact.

-

Deregulation: The administration pursued a significant deregulation agenda across various sectors. The argument is that reduced regulatory burdens lead to increased efficiency and economic activity. However, deregulation can also carry significant risks, particularly regarding environmental protection and consumer safety. A comprehensive cost-benefit analysis, considering both short-term economic gains and potential long-term costs (e.g., environmental damage, health risks), is essential for a balanced assessment.

-

Energy Independence: Increased domestic oil and gas production under the Trump administration led to lower energy prices. This had a positive impact on consumer spending and industrial production. However, the long-term sustainability of this approach is debatable. The environmental consequences of increased fossil fuel production need careful consideration, alongside the volatility of energy prices in a global market. Analyzing the impact on renewable energy development is also critical.

-

Trade Policies (Negotiating New Trade Deals): The administration renegotiated NAFTA (creating USMCA) and engaged in trade disputes with China. While some argue these actions protected American industries and jobs, others point to disruptions in global supply chains, increased trade tensions, and potential negative impacts on consumers through higher prices. A detailed study comparing pre- and post-policy trade flows, employment levels in affected sectors, and consumer price indices is crucial for a balanced evaluation.

-

Unemployment Rates: Low unemployment rates were frequently cited as a success. However, it’s essential to examine the nature of the jobs created. Were they high-paying jobs or low-wage jobs? Were they full-time or part-time positions? Analyzing participation rates and wage growth data provides a more complete picture than simply focusing on headline unemployment numbers.

-

Economic Growth: While GDP growth was positive during parts of the Trump administration, comparing this growth to previous administrations and considering global economic factors is essential. Was this growth sustainable? What were the contributing factors besides administration policies? Longitudinal analysis of GDP growth, coupled with an assessment of inflation and national debt, provides context.

-

Stock Market Performance: Rising stock market indices are often cited as a sign of economic success. However, stock market performance doesn’t necessarily reflect the overall economic well-being of the population. It can be influenced by factors like monetary policy, investor sentiment, and global events, independent of specific administration policies. Analyzing wealth distribution alongside stock market performance would offer a broader perspective.

Conclusion:

Attributing specific economic outcomes solely to the policies of a single administration is an oversimplification. A thorough assessment requires a detailed examination of numerous interacting factors, including global economic trends, technological advancements, and the legacy of previous administrations. While some positive economic indicators occurred during the Trump administration, a critical evaluation necessitates a deeper dive into the complexities of causation and a consideration of both short-term gains and long-term consequences. Without rigorous empirical analysis and a multifaceted perspective, claims of unqualified “economic victories” remain unsubstantiated.